The inventory turnover ratio measures how often a company has sold and replaced its inventories in a specified period, i.e. the number of times inventories were “turned over”. Inventory has a value – even before you do anything with it – and so it’s listed as an asset on your business balance sheet. But it can lose its value fast if it gets old, out of date, damaged, or the market price for that type of product drops. Unlike IAS 2, US GAAP does not allow asset retirement obligation costs incurred as a consequence of the production of inventory in a particular period to be a part of the cost of inventory. Instead, such costs are added to the carrying amount of the related property, plant and equipment.

Best Practices for Effective Inventory Management

You should also maintain inventory levels and control sales to meet customer demands. The reason for the three accounts is that purchases (increases) are at cost, and sales (decreases) are at selling price (i.e. they include a profit). If both sales and purchases were recorded on one account the balance would be a meaningless figure including the profit element, and would not represent the correct beginning or ending balance.

What Are the Benefits of Inventory Management?

Companies and individuals must produce the appropriate financial statements and income tax returns each year as dictated by their country’s revenue collection agency. Failure to comply with this will result in fines, penalties and possible incarceration. The perpetual inventory system records and tracks inventory balances continuously. Updates are made automatically to this system, tracking when products come in and out of the inventory account. In the United States, GAAP requires that inventory is stated at replacement cost if there is a difference between the market value and the replacement value, but upper and lower boundaries apply.

How to calculate finished goods inventory

This will be done with simple, easy-to-understand, instructive examples involving a hypothetical retailer Corner Bookstore. Success in inventory management and ecommerce success partly depends on your merchants, so choose wisely. Your business will be severely affected when your suppliers fail to deliver the required inventory, leading to stockouts or delayed order fulfillment. Likewise, if they provide products with subpar quality, your business and brand reputation will suffer. Cloud inventory management solutions and other software options can automate real-time tasks like tracking and monitoring your inventory count.

Understanding and Managing Customer Deposits in Financial Reporting

When recording an inventory item on the balance sheet, these current assets are listed by the price the goods were purchased, not at the price the goods are selling for. Opening and ending inventory balance will need to be recorded on the balance sheet each period. The main advantage of inventory accounting is to have an accurate representation of the company’s financial health.

In this case, our beginning inventory was $200,000 and our inventory was $300,00, giving us an average inventory of $250,000. The DIO metric looks at how quickly your business turns over its inventory. Nurture your relationship with them as they’re the ones that can help reduce lead times and enhance your supply chain efficiency. If the net realizable value of the inventory is less than the actual cost of the inventory, it is often necessary to reduce the inventory amount.

This technology enhances inventory accuracy, reduces labor costs, and can significantly speed up processes like receiving, picking, and shipping. Advanced inventory management transcends basic stock-keeping practices, integrating sophisticated techniques and technologies to optimize the supply chain. One such technique is Just-In-Time (JIT) inventory, which reduces waste credits and deductions for individuals by receiving goods only as they are needed in the production process. This method minimizes holding costs and can improve cash flow, but it requires precise demand forecasting and strong supplier relationships to avoid stockouts. Inventory turnover ratio, an indicator of how efficiently a company manages its inventory, is derived from inventory accounting figures.

The percentage of gross profit margin is revised, as necessary, to reflect markdowns of the selling price of inventory. Like IAS 2, US GAAP companies using FIFO or the weighted-average cost formula measure inventories at the lower of cost and NRV. Unlike IAS 2, US GAAP companies using either LIFO or the retail method compare the items’ cost to their market value, rather than NRV. Management uses the inventory turnover and the margin ratios to measure the earnings from each piece of merchandise and stock items that will produce more profits for the company. Investors and creditors also look at these ratios as a health indicator of the company.

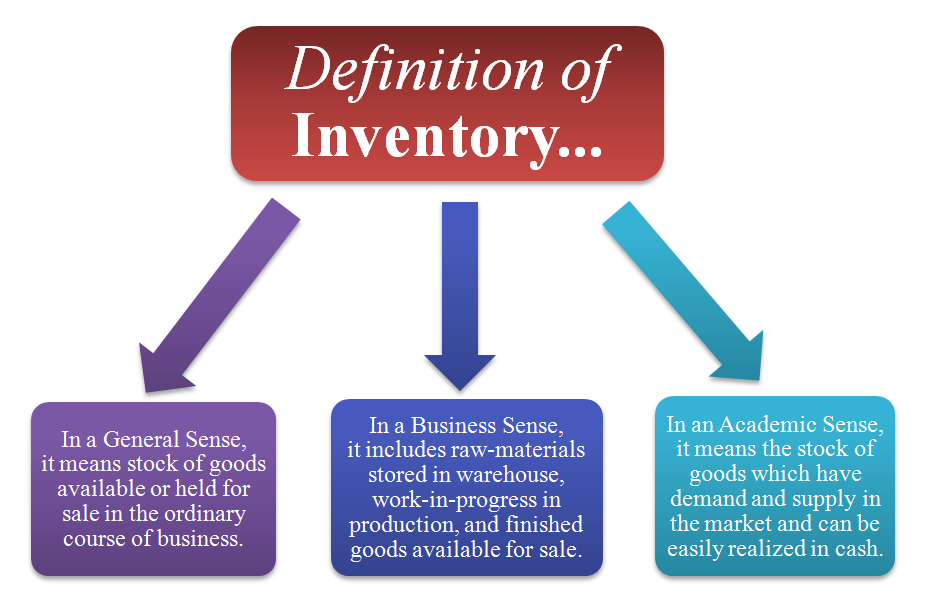

- They may also refer to stock bought by a company in its final form and not yet sold to customers.

- The LIFO method, or last-in, first-out technique, asserts that the last stock added to inventory will be the first sold.

- While the majority of US GAAP companies choose FIFO or weighted average for measuring their inventory, some use LIFO for tax reasons.

- To accurately calculate and record the valued inventory each year, businesses must select one of these costing methods and apply it consistently.

- So in theory, it should be an asset, but it gets converted to cans of beer and sold over time.

Proper communication and collaboration are critical to a successful and efficient inventory process. With no proper exchange of information, employees will not know their tasks, how to progress, and the status of their work, which can result in disrupted workflow in the inventory warehouse. Double Entry Bookkeeping is here to provide you with free online information to help you learn and understand bookkeeping and introductory accounting. Bookkeeping and accounting is achieved using three separate accounts as follows. Manage complex financials, inventory, payroll and more in one secure platform.

Under IAS 2, inventory may include intangible assets that are produced for resale – e.g. software. Like IAS 2, transport costs necessary to bring purchased inventory to its present location or condition form part of the cost of inventory. Unlike IAS 2, US GAAP does not contain specific guidance on storage and holding costs, which may give rise to differences from IFRS Standards in practice. US GAAP does not provide specific guidance around accounting for assets that are rented out and then subsequently sold on a routine basis, and practice may vary.

Led by Mohammad Ali (15+ years in inventory management software), the Cash Flow Inventory Content Team empowers SMBs with clear financial strategies. We translate complex financial concepts into clear, actionable strategies through a rigorous editorial process. This comprehensive guide will provide you with a deep understanding of inventory accounting, its methods, and its impact on profit and taxation. Another prevalent method is Last-In, First-Out (LIFO), where the most recently acquired items are considered sold first. LIFO can lead to reduced taxes during inflationary periods, as it typically increases the cost of goods sold and lowers net income.