Process costing is most appropriate when an organization’s units of production are identical, or almost identical, such that each individual unit of production consumes the same amount of manufacturing input resource. In such cases, rather than calculate separate costs for each unit, an average per unit cost can be applied across the board. Another important aspect of management accounting is how and when to recognize the costs of making, acquiring or providing products and services.

Factory Overhead

It is the difference in total cost that will arise from the selection of one alternative to the other. It is a predetermined cost based on past performance adjusted to the anticipated changes. It can be used in any business situation or decision making which does not require accurate cost. Sometimes, if the direct expenses are negligible or small amount, it will be treated as overhead. On the basis of careful analysis and estimation, standard costing establishes an array of acceptable costs that an organization expects to incur, and monitors actual costs against these standards.

Do you own a business?

This cost is not affected by a particular decision under consideration. Sunk-costs are always results of decisions taken in the past;-This cost cannot be changed by any decision in future. Investment in plant and machinery as soon as it is installed, its cost is sunk cost and is not relevant for decisions. The sunk costs are those costs that have been invested in a project and which will not be recovered if the project is terminated. This concept is similar to the economists’ concept of marginal cost which is defined as the additional cost incurred by producing one more unit of product.

A Guide to Frog Cremation Urns: Exploring the Types, Costs, and Best Places to Purchase

Audio & Media Services revenue increased $28.1 million, or 45.3%, primarily as a result of higher political revenue and an increase in digital revenue. At Oaktree Memorials, we understand the profound impact that a frog can have on our lives. That’s why we’re dedicated to helping you find the perfect way to memorialize your cherished companion. Whether you’re searching for the ideal frog cremation urn or exploring alternative options, we’re here to guide you every step of the way.

- These costs are recorded in the books of account and can be easily measured.

- Costs must be determined and recorded accurately, systematically, and on a timely basis.

- Examples include direct materials, direct labor, and sales commission based on sales.

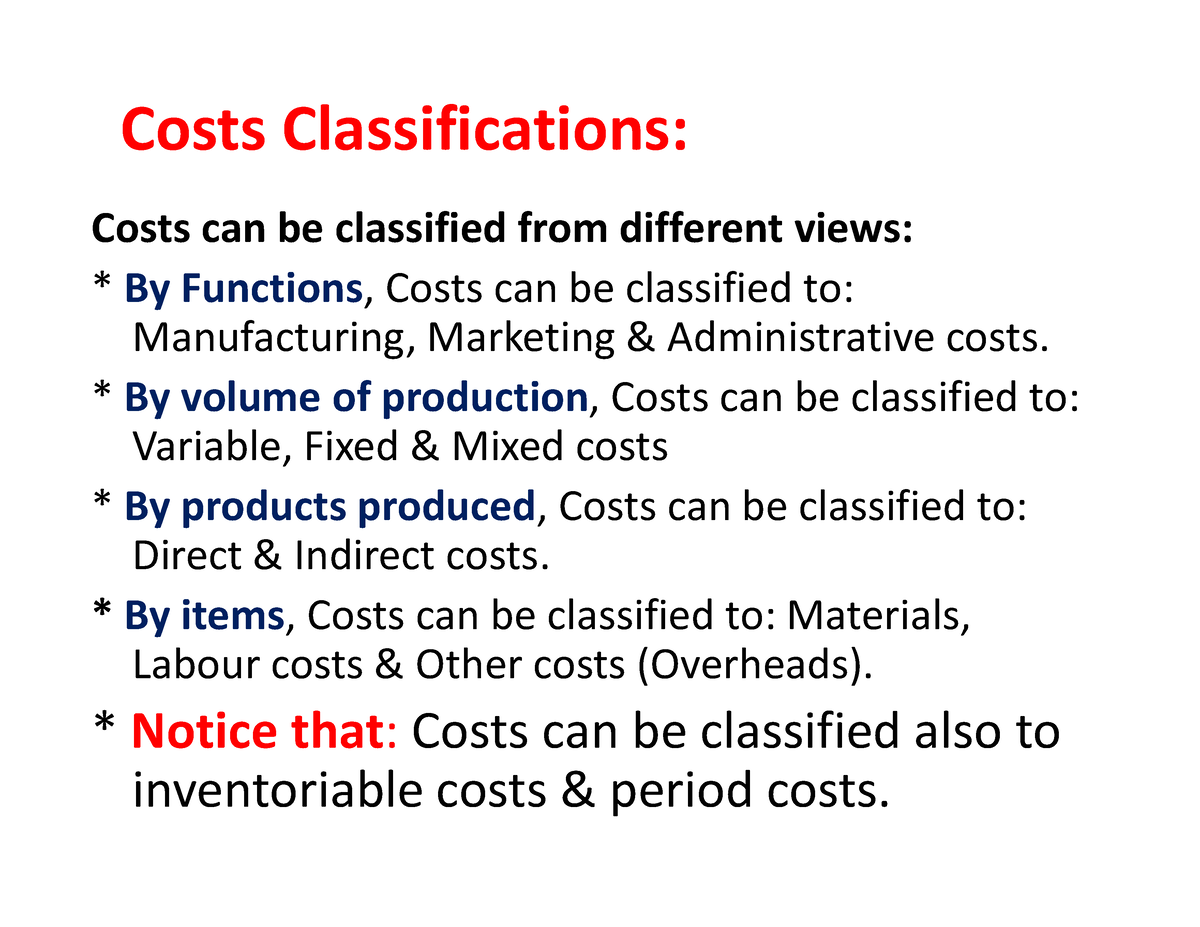

What is Cost Behavior and Cost Classification?

For example, suppose a company leases a machine for production for two years. The company has to pay $2,000 per month to cover the cost of the lease, no matter how many products that machine is used to make. One part of semi-variable costs remains constant irrespective of changes in the volume of output or sales.

For the nine months ended September 30, 2024, cash provided by operating activities was $70.2 million, cash provided by investing activities was $23.5 million and cash used for financing activities was $8.4 million. Certain prior period amounts have been reclassified to conform to the 2024 presentation of financial information throughout the press release. If you’re drawn to the idea of a more interactive memorial, you subject to change 2021 could explore the option of a frog-themed garden or habitat. This could involve planting native plants, creating a small pond or water feature, and even incorporating frog-friendly structures, such as a decorative toad house or a rock pile for your frog to hide under. By creating a living, thriving environment, you can honor your frog’s memory in a way that celebrates their natural habitat and the cycle of life.

The urgent costs are those which must be incurred in order to continue operations of the firm. For example, cost of material and labour must be incurred if production is to take place. The shutdown costs are the costs incurred in relation to the temporary closing of a department / division / enterprise. The shutdown costs are defined as those costs which would be incurred in the event of suspension of the plant operation and which would be saved if the operations are continued. The sunk cost is one for which the expenditure has taken place in the past.

When it comes to storage, it’s best to keep the urn in a dry, cool, and out-of-the-way location, such as a shelf or cabinet. Exposure to direct sunlight, extreme temperatures, or high humidity can potentially cause the urn to deteriorate over time. If you plan to display the urn, consider placing it in a protected area, such as a glass-enclosed case or a dedicated memorial space in your home. One particularly striking design feature is the inclusion of lifelike frog figurines or sculptures adorning the urn.

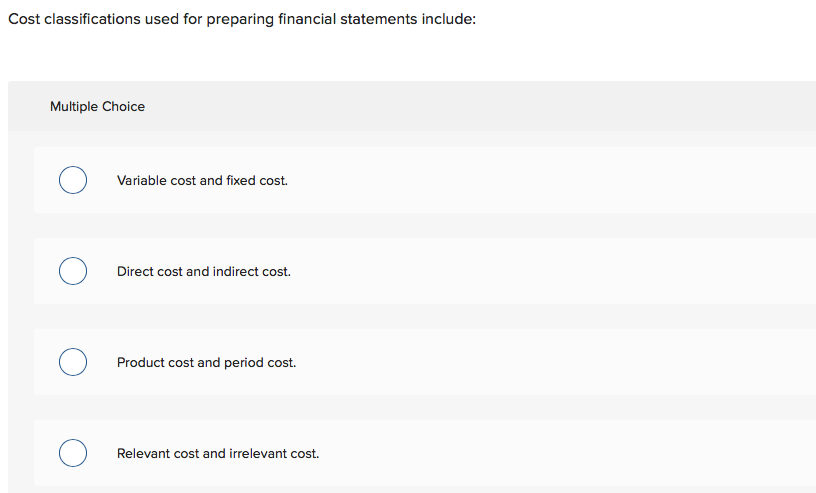

Additionally, some independent artisans and specialty memorial shops may offer unique, handcrafted frog urns that you won’t find anywhere else. Business costs comprise all the payments and contractual obligations made by a business, added to the book cost of depreciation of plant and equipment. These costs are used to calculate the profit or loss made by a business, filing for income tax returns and other legal procedures. Managerial accounting deals with a wide variety of issues, including revenue forecasts, budgeting, capital decision making, and other non-cost issues, as you will see in this course.

It is worth remembering that fixed costs are not absolutely fixed for all of time. In fact, fixed costs are fixed only in relation to a particular level of production capacity. These costs remain fixed in total but their per-unit cost changes with output or sales. Fixed costs are costs that generally remain unaffected by changes in sales volume/output. Fixed costs remain unchanged when output or sales increase or decrease. These costs tend to increase or decrease with the rise and fall in production or sales.

Indirect costs cannot be directly allocated to cost units or cost centres and have to be absorbed or recovered into cost units. Cost is the amount of money that a business uses in the production of goods or services. These include the expenditure incurred in production, from raw materials and labor to overhead costs. It is a very imperative determinant concerning the profitability and health of a business.