Our team is ready to learn about your business and guide you to the right solution. Bench simplifies your small business accounting by combining intuitive software that automates does prepaid rent affect net income the busywork with real, professional human support. Sales below the break-even point mean a loss, while any sales made above the break-even point lead to profits.

How Do You Calculate a Breakeven Point?

This means that the investor has the right to buy 100 shares of Apple at $170 per share at any time before the options expire. The breakeven point for the call option is the $170 strike price plus the $5 call premium, or $175. If the stock is trading below this, then the benefit of the option has not exceeded its cost. Your business needs to generate $250,000 in revenue to cover all operating expenses and break even.

Where Should We Send Your Answer?

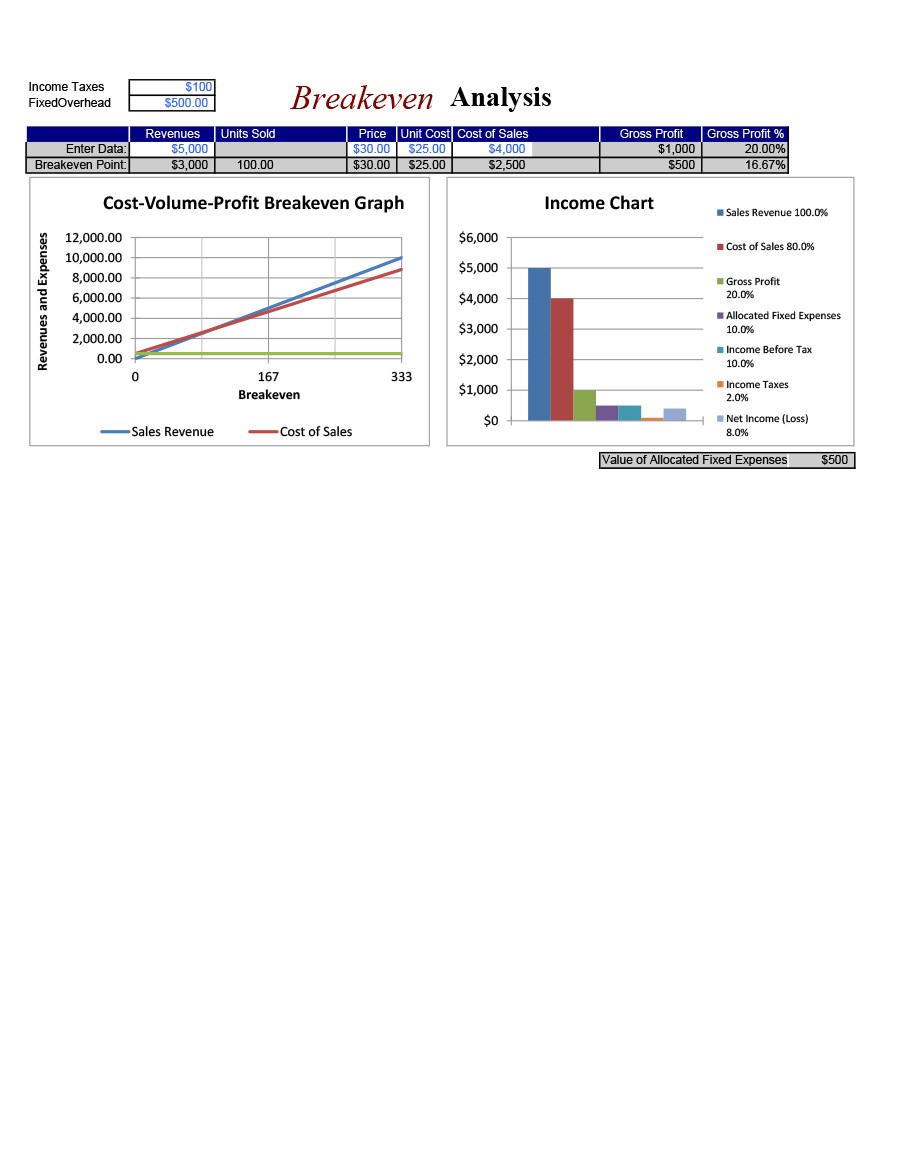

All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly. The break-even point or cost-volume-profit relationship can also be examined using graphs. Using the algebraic method, we can also identify the break-even point in unit or dollar terms, as illustrated below. This section provides an overview of the methods that can be applied to calculate the break-even point. It is possible to calculate the break-even point for an entire organization or for the specific projects, initiatives, or activities that an organization undertakes. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader.

- This means that the investor has the right to buy 100 shares of Apple at $170 per share at any time before the options expire.

- On the other hand, variable costs are largely dependent on the volume of work at hand – if you have more clients, you will need more labor and materials which results in an increase in variable expenses.

- If you’re having trouble hitting your break-even point or it seems unreachable, it’s time to make a change.

- In general, the break-even price for an options contract will be the strike price plus the cost of the premium.

- The following break-even point analysis formulas will help you get there.

What is the basic objective of break-even point analysis?

Knowing the break-even interest rate is important in comparing bonds. With it, you can make your own predictions about what the future will bring and make a decision accordingly. To get a better sense of what this all means, let’s take a more detailed look at the formula components.

It’s also effective for cash management as it helps you look at your expenses, sales, and profits in detail. Calculating your company’s break-even point is important to the overall health of your business. It can be used to make informed decisions and develop a long-term business plan for your company’s future success. But first, you’ll need to know how to perform a break-even analysis. According to this formula, your break-even point will be $200,000 in sales revenue. This analysis shows that any money generated over $200,000 will be net profit.

When it comes to stocks, for example, if a trader bought a stock at $200, and nine months later, it reached $200 again after falling from $250, it would have reached the breakeven point. It’s also important that you, as a business owner, know the total contribution margin of each of your products or services. Only then can you make strategic business decisions that will ensure your company thrives and gains an advantage in your market. A contribution margin formula is a useful tool that you can use to plan sales and costs of sales. The break-even point (BEP) is when your forecasted revenue equals your estimated total costs. When you’re just starting out, your business may face losses for a few years.

This point is also known as the minimum point of production when total costs are recovered. As we can see from the sensitivity table, the company operates at a loss until it begins to sell products in quantities in excess of 5k. For instance, if the company sells 5.5k products, its net profit is $5k. Consider the following example in which an investor pays a $10 premium for a stock call option, and the strike price is $100. The breakeven point would equal the $10 premium plus the $100 strike price, or $110.

The break-even point formula can determine the BEP in product units or sales dollars. A breakeven point is used in multiple areas of business and finance. In accounting terms, it refers to the production level at which total production revenue equals total production costs.

However, costs may change due to factors such as inflation, changes in technology, and changes in market conditions. It also assumes that there is a linear relationship between costs and production. Break-even analysis ignores external factors such as competition, market demand, and changes in consumer preferences.

Whatever challenges you’re facing, conducting a break-even analysis can help you find solutions. The break-even analysis helps business owners perform a financial analysis and calculate how any changes will affect the time it takes to break-even and, therefore, turn a profit. If you won’t be able to reach the break-even point based on your current price, you may want to increase it. Increasing the sales price of your items may seem like an impossible task. For many businesses, the answer to both of these questions is yes. Break-even price as a business strategy is most common in new commercial ventures, especially if a product or service is not highly differentiated from those of competitors.