Get reports on project or portfolio status, project plan, tasks, timesheets and more. All reports can be filtered to show only the cost data and then easily shared by PDF or printed out to update stakeholders. You can find the overhead rate of your manufacturing operations using the following formula. These physical costs are calculated either by the declining balance method or a straight-line method. The declining balance method involves using a constant rate of depreciation applied to the asset’s book value each year.

Managerial Accounting

Since it varies with production volume, an argument exists that variable overhead should be treated as a direct cost and included in the bill of materials for products. You can also use the formula below to calculate a predetermined manufacturing overhead cost rate that will be allocated to all the units that are produced instead of allocating overhead costs to each of them. Continuous improvement methodologies, such as Lean and Six Sigma, can also be employed to streamline processes and reduce waste. By focusing on value-added activities and eliminating non-essential tasks, companies can lower the consumption of indirect materials and utilities, thus reducing variable overheads. Additionally, investment in energy-efficient machinery and equipment can lead to long-term savings in utility costs, which are often a significant portion of variable overheads. Indirect labor is another component, which refers to the wages of employees who are not directly involved in the production of goods but whose work is related to the production process.

- A variable overhead spending variance is the difference the actual costs and what it should have cost based on the activity level.

- Managing variable overhead costs effectively begins with the implementation of a robust monitoring system.

- Variable overhead costs are costs that change as the volume of production changes or the number of services provided changes.

- If the variance is significant, management will investigate what caused the variance.

- The term fixed manufacturing overhead refers to all factory overhead costs that do not depend on the production volume of a manufacturing business.

Applied Manufacturing Overhead

If the variance is significant, management will investigate what caused the variance. Variances in variable manufacturing overhead are classified as either a spending variance or an efficiency variance. Unfavorable spending variances occur when the factory purchases items at a higher rate than expected. For example, if the cost of a kilowatt of electricity went up or if a purchaser had to pay more on machine supplies than usual, there could be a spending variance. Unfavorable efficiency variances occur when the factory uses more variable overhead per unit than expected.

Examples of Manufacturing Overhead Costs

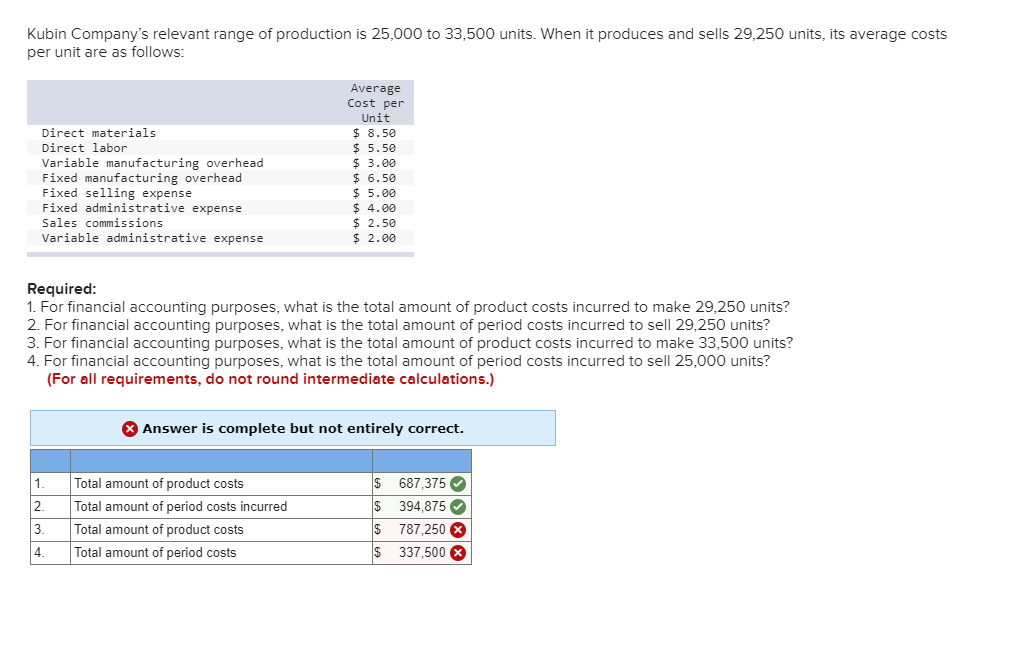

These costs are then allocated to each unit that’s produced and documented as part of the cost of goods sold in a manufacturer’s master budget. While the direct costs of labor and materials are usually easy to calculate based on production volumes, variable overhead costs are not so easy. Variable manufacturing costs vary roughly with changes in production volumes.

Semi-Variable Overhead Costs

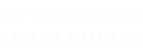

Within manufacturing overhead, some costs are fixed — meaning, they don’t tend to change as production increases — and others are variable. Variable manufacturing overhead costs differ based on how much the company produces. Before production begins, a business will typically calculate a standard or estimated variable manufacturing overhead for the year. Accountants come up with this figure by analyzing historical data and determining how much variable overhead expense the company tends to incur per unit produced. For example, if variable overhead costs are typically $300 when the company produces 100 units, the standard variable overhead rate is $3 per unit.

Conversely, companies with more variable costs than fixed might have an easier time reducing costs during a recession since the variable costs would decline with any decline in production due to lower demand. Cost behavior refers to the way in which a cost changes in relation to changes in the level of business activity or volume of production. This variance is unfavorable for Jerry’s Ice Cream becauseactual costs of $100,000 are higher than expected costs of$94,500. Variable overhead is typically aggregated into the cost of goods sold, and so is not shown separately in the income statement. However, it may be listed as a separate line item in the cost of goods manufactured schedule, which is internal to the accounting department; it is not included in a company’s financial statements. There are many costs that occur during production that it can be hard to track them all.

Another example is the cost of the manufacturing supplies (such as needles and thread) that increase when production increases. We will assume that these variable manufacturing overhead costs fluctuate in response to the number of direct labor hours. The three primary components of a product cost are direct materials, direct labor and manufacturing overhead. Manufacturing overhead is a catch-all account that includes all manufacturing costs a business incurs other than direct materials and direct labor.

It encompasses all the indirect expenses tied to the manufacture of products that are not fixed costs. Let’s say the company increases its sales of phones, accounting for contingent liabilities and in the following month, the company must produce 15,000 phones. At $2 per unit, the total variable overhead costs increased to $30,000 for the month.

The higher the percentage, the more likely you’re dealing with a lagging production process. Manufacturing overhead is the sum of all the manufacturing costs except direct labor or direct materials costs. You can calculate applied manufacturing overhead by multiplying the overhead allocation rate by the number of hours worked or machinery used. So if your allocation rate is $25 and your employee works for three hours on the product, your applied manufacturing overhead for this product would be $75. The labor involved in production, or direct labor, might not be variable cost unless the number of workers increases or decrease with production volumes.