In many factories, these stock materials are kept in a physical location different from other inventory, which makes it easier to control and account for this indirect manufacturing cost. The key is choosing an appropriate cost driver – like machine hours in manufacturing or headcount in sales – to distribute overhead expenses. Rather than lump overhead costs into one expense account, businesses should allocate fixed and variable overhead to departments. Hence, you can apply this predetermined overhead rate of 66.47 to the pricing of the new product X. The predetermined overhead rate calculation shown in the example above is known as the single predetermined overhead rate or plant-wide overhead rate. This example helps to illustrate the predetermined overhead rate calculation.

- As discussed above, a business must wait until the end of a period to know the actual performance in terms of overheads incurred.

- This can result in abnormal losses as well and unexpected expenses being incurred.

- For example, machines need oil and lubricants to operate, and workers use sandpaper and grinding wheels to shape and polish parts, etc.

- Some of the best ways to control the cost of manufacturing are through machine-augmented manual work and automation of repetitive tasks.

- Her expertise lies in marketing, economics, finance, biology, and literature.

Which of these is most important for your financial advisor to have?

Similarly, as mentioned above some businesses may use it as a monitoring and control tool. If the predetermined overhead rates are not accurate, they can force the business to control its activities according to unrealistic rates. Furthermore, when actual costs are compared to the budgeted costs based on predetermined overhead rates, the variances may be too significant.

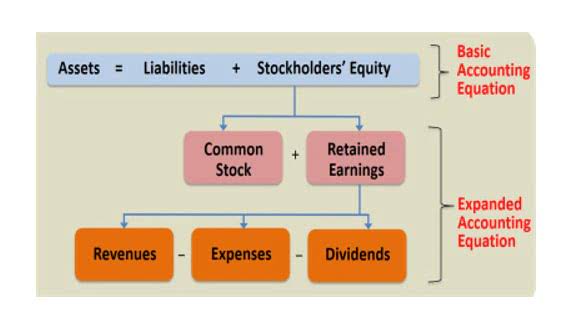

Determining the Predetermined Overhead Rate Formula

The POR is used to apply overhead costs to products or job orders, helping businesses predetermined manufacturing overhead rate formula to accurately price their products, manage budgets, and analyze cost behavior. It’s particularly useful in scenarios where indirect costs are significant and need to be fairly allocated across different products or services. If the estimated overhead is $200,000 and the direct labor costs are $150,000, the predetermined overhead rate is $1.33 for every dollar of labor costs. While assessing how direct labor costs impact total manufacturing costs is fairly easy, it’s more difficult to account for indirect labor or overhead expenses. Companies can use predetermined overhead rates to prepare competitive bids for projects by offering prices that accurately reflect their overhead costs.

Production Volumes and Product Customization

However, small organizations with small budgets cannot afford to have multiple predetermined overhead allocation mechanisms since it requires experts to determine the same. Therefore, the single rate overhead recovery rate is considered inappropriate, but sometimes it can give maximum correct results. Businesses should understand which overhead costs are fixed vs variable when budgeting and setting overhead rates.

How Do You Calculate Allocated Manufacturing Overhead?

Their amount of allocated overhead is not publicly known because while publications share how much money a movie has produced in ticket sales, it is rare that the actual expenses are released to the public. Carefully minimizing overhead is crucial for small businesses to maintain profitability. Following expense optimization best practices and leveraging technology keeps overhead costs in check. This aids data-driven decision making around overhead rates even for off-site owners and managers. Built-in analytics help uncover spending trends and quickly flag unusual variances for further investigation. Using small business accounting software centralizes overhead tracking and analysis.

Company B wants a predetermined rate for a new product that it will be launching soon. Its production department comes up with the details of how much the overheads will be and what other costs will be incurred. Sourcetable, an AI-powered spreadsheet, streamlines complex calculations, empowering you to focus on results rather than processes. With features tailored for easy calculation and the ability to test these on AI-generated data, Sourcetable makes it easier and quicker to apply overhead rates in various scenarios.

Calculate Predetermined Overhead Rate

Materials consumed during production but not part of the finished product are classified as indirect materials. These include lubricants, abrasives, adhesives, cutting tools, dunnage, and temporary holding fixtures. Sourcetable, an AI-powered spreadsheet, greatly fixed assets simplifies the process of computing these rates and other financial metrics. Its intuitive interface and powerful computational capabilities allow users to perform complex calculations with ease.

- Ahead of discussing how to calculate predetermined overhead rate, let’s define it.

- Renegotiating contracts with vendors may yield savings on supplies or services.

- Having complete and up-to-date financial information helps managers correctly plan for future production demands.

- Manufacturing overhead costs include all manufacturing costs except for direct materials and direct labor.

What Are the Limitations of Predetermined Overhead Rates?

Obotu has 2+years of professional experience in the business and finance sector. Her expertise lies in marketing, economics, finance, biology, and literature. She enjoys writing in these fields to educate and share her wealth of knowledge and experience. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

In some industries, the company has no control over the costs it must pay, like tire disposal fees. To ensure that the company is profitable, an additional cost is added and the price is modified as necessary. In this https://www.bookstime.com/ example, the guarantee offered by Discount Tire does not include the disposal fee in overhead and increases that fee as necessary.